The Washtenaw Voice

by Robert Conradi

1/24/2011

Local entrepreneur Donald Snider discusses pizza and his book.

Chasing the almighty dollar has always been one of the primary goals of Donald Snider, but only recently did he realize that the big dough was in pizza.

Succeeding in many different industries over the course of his life, one of the most successful local entrepreneurs has again found one that has brought him more success — Papa John’s Pizza.

The owner of two pizza establishments in the Ann Arbor area, Snider was announced as Man of the Year by “Native Detroiter” magazine, which also features Congressman John Conyers and former Detroit Mayor Kenneth Cockrel Jr. as co-Men of the Year.

“Although earning a living and employing people in the community was very important to Mr. Snider, his true focus was leaving a legacy for his children and grandchildren, which he someday hoped to be blessed with,” the magazine writes of Snider.

Snider shares his story and gives details about his life in his 2009 book “Beyond the Bling.” In it, he offers suggestions for financial success.

“I really wrote the book to leave behind for my family members,” said Snider. “Mostly at speaking engagements, they want me to talk about the book and bring the book to sell.”

Born in Detroit, Snider moved to Chicago as a child, but came back to Michigan for college.

Snider earned a bachelor’s degree from Wayne State University in biology and his master’s degree from Central Michigan University.

After college, Snider found that success wasn’t always going to come easily. Following stints with several low-paying jobs, Snider made one of his first big strides as the owner and CEO of Paper-Plas Converting Inc., a supplier of packaging materials to the automotive industry. Most of his previous working experience came from owning five Kentucky Fried Chicken franchises, so the leap to automotive supplier seemed like a stretch. Thanks to his work ethic, Snider made it happen.

“I work seven days a week and so does he,” said Cameron Farmer, operations manager for Walden Foods, a company created by Snider. “He’s the guy that will call you at 8 a.m. or at 1 a.m. I don’t know when he gets the time to sleep!”

In 1995, Chrysler was looking for a new supplier to provide paper and, as a long shot, Snider’s company received the job. Eventually, Paper-Plas became one of the fastest-growing, minority-owned paper-packaging companies in the United States.

But it became a victim of the recession when the economy crashed a few years ago. His company hung on until 2009 before shutting down. Soon, Snider was looking for new opportunities.

“The automotive industry was changing so I started looking for opportunities to get out,” said Snider. “That’s how I got into Papa John’s Pizza. But it could have been selling paperclips and walnuts. Anything with positive cash flow, I wanted to get into it.”

Snider realized selling pizza and working with food could be a good way to maximize profit — and he was right.

“I accomplished one goal already,” said Snider. “It just kind of came years ago. I reached accumulating a million dollars.”

And his employees are flour ishing with him.

“He’s one of those guys that does exactly what he says,” said Farmer. “You knew what was expected and what to give him, which makes things simple. I haven’t had a negative experience with him.”

At 57, Snider doesn’t have plans of giving it up anytime soon. He purchased his first Papa John’s Pizza franchise in downtown Ann Arbor in December 2009 and recently opened up another in Ypsilanti last August. The two are subsidiaries of Walden Foods, which oversees the operations of Washtenaw County Papa John’s restaurants and several coffee shops at Detroit Metro Airport.

“I knew in the Metro Detroit area it was highly competitive for pizzas, but I didn’t know it was this competitive to actually get in it,” said Snider. “I’m used to having a built-in customer like a Chrysler. In this business you have to market at all times. Even when I go to church on Sunday, I make sure I wear some type of Papa John’s logo.”

Snider opened up a new location in Ypsilanti because the downtown Ann Arbor location can have inconsistent sales. The new location has about 35,000 cars drive by each day.

“The Papa John’s downtown to me is so dependent on UM students,” said Snider. “I don’t like operating like that, because when winter break and summer break comes, it’s dead. Even though (the new location) is five minutes from Eastern Michigan, we don’t depend on Eastern.”

So what happens to a man whose business is dependent upon college students?

“I don’t rest well,” said Snider. “I don’t rest well if I’m not selling pizzas.”

Snider has three children, who all strive to be as successful their father. However, Snider doesn’t plan to expand his business any further until more family is involved in his operations.

Despite his success — or perhaps because of it — Snider has remained true to himself in order to reach his goals. Maintaining good credit is imperative to success, he said, offering a just a few words for college students looking to make their own entrepreneurial mark.

“What kids should do with their credit cards, being that they’re unsecured, instead of buying pizza, hamburgers and the latest jersey, they should have used the credit card to buy books and pay for tuition,” said Snider. “That way, at least your education is paid for. They can’t take that away from you.”

Michael Shore

January 17, 2011

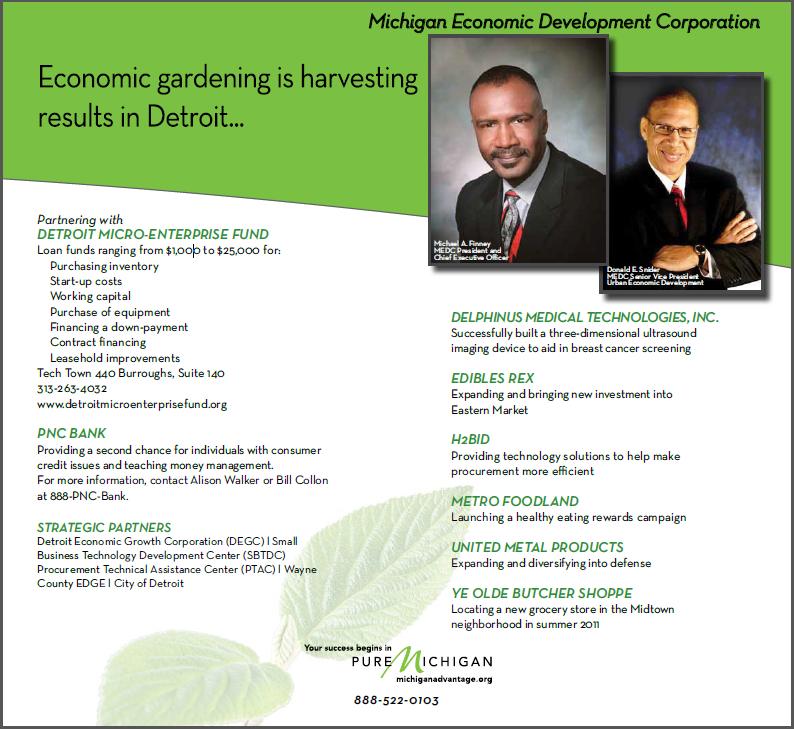

Elizabeth Parkinson, Donald E. Snider Named to Lead Marketing and Urban Economic Development Efforts

Hirings signal sharper focus on entrepreneurship, urban revitalization

LANSING – Michigan Economic Development Corp. President and CEO Michael A. Finney today announced Elizabeth Parkinson, former vice president, marketing and communications for Ann Arbor SPARK, MEDC senior vice president, marketing and communications, and Donald E. Snider, former president and CEO, Walden Foods in Ann Arbor, MEDC senior vice president, urban economic development.

“I have asked two talented and richly experienced economic development professionals to join me in setting a new course for the state’s economic development efforts,” Finney said. “Both Elizabeth and Donald are held in high regard by their colleagues and peers, and I know they will be a great addition to our team.”

At SPARK since November of 2005, Parkinson developed and implemented the Ann Arbor SPARK marketing strategy and plan implementing the Ann Arbor USA brand. During her tenure, SPARK grew to national recognition with aggressive public relations outreach, targeted advertising and the development and use of digital and social media tools. Under her direction, SPARK undertook the design and development of a range of online and collateral communication tools and supported over 150 annual educational, training and networking events. She also created and implemented the MichAgain talent attraction and retention initiative.

Prior to joining Ann Arbor SPARK, from 1992-2002, she was employed by Edelman Public Relations in Chicago and served as managing director of the Creative Solutions group developing, coordinating and executing creative campaigns for multi-national clients including: Microsoft, Kraft, KFC, Pizza Hut, FTD, Case IH, Allstate, , Abbott, , Pfizer, Fuji Film, Mexico Ministry of Tourism, Illinois Board of Tourism, Bacardi, Underwriters Laboratories andWhirlpool. Parkinson holds a B.A. degree in Marketing and Accounting from Alma College.

Snider’s career spans over 20 years with extensive experience in public and private administration roles. As president and CEO of Walden Foods, he owned and operated two Papa John’s franchises in Ann Arbor and Ypsilanti with 40 full and part-time employees serving the University of Michigan and Eastern Michigan University communities. From 1995-2009, Snider was president and CEO of Paper-Plas Converting, Inc., a tier one automotive supplier in Detroit and Milwaukee, WI. Past positions include: accounts manager for Randolph-General Medical Inc., Livonia; chief operations officer for New Center Hospital, Detroit; owner and operator of two Kentucky Fried Chicken stores in Illinois; and financial developer for the General Motor Institute for American Business, Detroit.

Snider has been recognized with several awards including: Michigan Minority Business Development Council Supplier of the Year in 2003, 2002 and 2000; and has served on numerous boards including: Davenport University Foundation Board, Detroit Area Pre-College Engineering Program and as a member of the Michigan Building Authority board under appointment by Governor Engler. He currently serves on the Henry Ford Health System and Chicago Federal Reserve Advisory boards. Snider is author of Beyond the Bling, a book about taking real steps to financial success. He holds a Masters of Public Administration degree from Central Michigan University.

The Michigan Economic Development Corporation, a partnership between the state and local communities, promotes smart economic growth by developing strategies and providing services to create and retain good jobs and a high quality of life.

For more information on the MEDC’s initiatives and programs, visit the website at www.MichiganAdvantage.org.

Donald Snider’s next step

Ann Arbor Observer Newspaper

posted 9/11/2010

Donald Snider has an intriguing resume. He owned five Kentucky Fried Chicken franchises in Illinois and Georgia from 1986 to 1989, sold them to move back home to Detroit to raise his two children as a single parent, and took a series of jobs that ran the gamut from registering people to vote and working at a gas station to teaching science at the Detroit College of Business and founding a company that sold paper products to automotive giants like Chrysler. Somewhere in there he found the time to write and publish a self-help book called Beyond the Bling: Real Steps to Financial Success. Oh, and he sits on the advisory board of the Federal Reserve Bank of Chicago. The fifty-seven-year-old Snider has even picked up a few awards along the way, including the Black Enterprise Small Business Award for Business Innovator of the Year in 1999.

Now he’s added Papa John’s Pizza franchisee to his resume. When he got out of the paper business a year ago–“because Chrysler stopped paying me”–Snider started looking around for another business opportunity.

“It could have been selling walnuts, paper clips, whatever had positive cash flow.” But he happened to know the owners of the Papa John’s franchise at the corner of Huron and Division, and last winter he decided to buy it. It did so well he opened a second Papa John’s in early August on Washtenaw a quarter mile east of Carpenter Road.

Papa John’s specializes in specialty pizzas, including spinach alfredo, smokehouse bacon and ham, and the “Cheesy Chicken Cordon Bleu.” Prices range from $9 to $15 depending on the size, and additional toppings are extra. It also has smaller fare like Buffalo wings, chicken strips, and garlic parmesan breadsticks. It’s takeout or delivery only.

Snider went full out to let everyone know there was a new Papa John’s in town, personally plastering the surrounding area with flyers. “I hand-delivered [the flyers] to auto dealerships, car repair guys, Discount Tire, offices–anything to spread the word.”

Papa John’s Pizza, 4559 Washtenaw. 975-7272. Daily 10:30 a.m.-midnight. papajohnsonline.com ![]()

Freep.com:

Posted: July 8, 2010

Congress looks at starting $30 billion fund for loans

Donald Snider of Franklin, in his second Papa John's franchise in Washtenaw County, launched a food business after a lender pulled financing for his auto parts firm.

BY GREG GARDNER | FREE PRESS BUSINESS WRITER

Despite billions of dollars in federal assistance, banks burned by bad loans continue to be stingy with credit — reducing available funds, raising interest rates on loans and rejecting many applicants altogether.

It’s not just frustrating small-business owners such as Jeff Emerson, who owns American Gear & Engineering machine shop in Westland. Experts, including Federal Reserve Chairman Ben Bernanke, say it also could be stalling the fragile U.S. economic recovery.

Take Emerson’s company, which repairs and makes specialized gears for automotive, defense and mining-related manufacturers. Although it lost money in 2009, Emerson said he has managed to make all the loan payments on time.

But now, Emerson said, his bank is threatening to pull his line of credit. Banks have seen so many companies fail since 2008 that many have toughened lending rules.

That’s a problem because, as the economy begins to recover, small businesses need cash to buy raw materials, add equipment and even hire because their customers need more of their services and products. Without that money, business will slow or stall.

“The bank could care less that business is improving,” Emerson said. “They just want to know what they would get” if the business failed.

Knowing this problem must be solved if the economy is to gain traction, Congress is considering a bill to create a $30-billion fund for small-business loans. On Tuesday, Sam’s Club also said it would step into the breach — offering loans to small businesses because surveys show they are having trouble getting credit.

1 owner switches fields while another presses on in parts

Emerson and Snider could determine whether a fledgling economic recovery gains momentum or fizzles out.

Emerson and his Westland machine shop, American Gear & Engineering, survived the worst of the downturn.

Now business is picking up gradually. But Emerson said PNC Bank is threatening to pull a line of credit just when American Gear needs to upgrade equipment and maybe hire people to keep up with stronger demand.

Snider, meanwhile, lost a small automotive parts-packaging business, Paper Plas, after JP Morgan Chase pulled his financing.

The New York bank in 2008 encouraged Snider to seek alternative financing because, he said, Chase told him it was afraid his largest customer, Chrysler, might go out of business.

Ironically, the large New York bank also led a group of banks and hedge funds that held $6.9 billion in loans to Chrysler. The government forced those lenders to accept about 29 cents on the dollar as part of Chrysler’s restructuring.

Today, Paper Plas is out of business. Snider launched Walden Foods, which operates Papa John’s pizza restaurants in Washtenaw County and Coffee Bean & Tea Leaf shops at Detroit Metro Airport.

Despite higher auto production, aggressive government investment in alternative energy technology and modestly stronger retail sales, small-business owners are still struggling to find financing.

“We saw some easing three or four months ago, but that has ended,” said Paul Brown, manager of capital access for the Michigan Economic Development Corp. “Credit is as tight now as it ever has been. It is particularly disheartening when many businesses are seeing increased sales and growth.”

Conservative practices

Emerson has battled with local representatives of PNC Bank that acquired National City Bank in 2008 with the help of $7.6 billion in Troubled Asset Relief Program money. PNC has since repaid that aid, plus a 5% dividend and $324 million from the sale of warrants granted to the U.S. Treasury in exchange for the TARP funds, but it’s not exactly gung-ho about making new loans.

“Upon acquiring National City, PNC implemented its own credit and risk policies,” said Fred Solomon, a spokesman for the Pittsburgh-based bank. “PNC traditionally has had very conservative risk-management practices.”

American Gear’s experience illustrates why the economic recovery hasn’t gathered momentum. Despite modest, but fundamental signs of growth, the loans needed to respond to that growth remain scarce.

PNC has begun a “second-look” program under which it is reviewing some rejected loan applications from the past year. Spokesman Solomon declined to say what the results of the initiative have been.

Snider, who did secure financing for a new Papa John’s in Ypsilanti, understands the banks’ dilemma. After years of loose credit and little regulation, regulators are demanding they raise more capital and reject high-risk borrowers.

Conflicting messages

“The banks’ conflict is that whatever someone like Bernanke says ‘Make more loans,’ regulators in the field are not giving them the same message,” said Snider. “It’s not that they don’t want to lend.”

MEDC’s Brown said the best hope for breaking the lending logjam is the Small Business Lending Fund Act, which the U.S. House of Representatives passed last month. Now before the Senate, the bill would create a $30-billion fund designed to increase small-business lending by community banks.

Proponents of the bill say this will result in $300 billion in new credit and lending to entrepreneurs.

About $2 billion would be apportioned among states that have innovative solutions. For example, when a company’s machinery is appraised below the value needed to support a conventional loan, some SBLF money could subsidize that collateral so the bank would feel safer making the loan.

“Literally every day matters,” Brown said. “Every day we don’t have access to capital that many more small Michigan employers could go out of business or just brown out.”