Freep.com:

Posted: July 8, 2010

Congress looks at starting $30 billion fund for loans

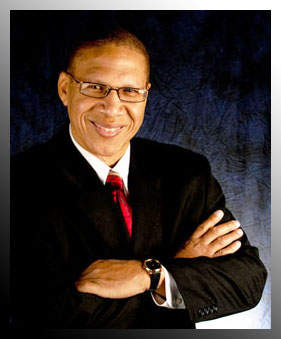

Donald Snider of Franklin, in his second Papa John's franchise in Washtenaw County, launched a food business after a lender pulled financing for his auto parts firm.

BY GREG GARDNER | FREE PRESS BUSINESS WRITER

Despite billions of dollars in federal assistance, banks burned by bad loans continue to be stingy with credit — reducing available funds, raising interest rates on loans and rejecting many applicants altogether.

It’s not just frustrating small-business owners such as Jeff Emerson, who owns American Gear & Engineering machine shop in Westland. Experts, including Federal Reserve Chairman Ben Bernanke, say it also could be stalling the fragile U.S. economic recovery.

Take Emerson’s company, which repairs and makes specialized gears for automotive, defense and mining-related manufacturers. Although it lost money in 2009, Emerson said he has managed to make all the loan payments on time.

But now, Emerson said, his bank is threatening to pull his line of credit. Banks have seen so many companies fail since 2008 that many have toughened lending rules.

That’s a problem because, as the economy begins to recover, small businesses need cash to buy raw materials, add equipment and even hire because their customers need more of their services and products. Without that money, business will slow or stall.

“The bank could care less that business is improving,” Emerson said. “They just want to know what they would get” if the business failed.

Knowing this problem must be solved if the economy is to gain traction, Congress is considering a bill to create a $30-billion fund for small-business loans. On Tuesday, Sam’s Club also said it would step into the breach — offering loans to small businesses because surveys show they are having trouble getting credit.

1 owner switches fields while another presses on in parts

Emerson and Snider could determine whether a fledgling economic recovery gains momentum or fizzles out.

Emerson and his Westland machine shop, American Gear & Engineering, survived the worst of the downturn.

Now business is picking up gradually. But Emerson said PNC Bank is threatening to pull a line of credit just when American Gear needs to upgrade equipment and maybe hire people to keep up with stronger demand.

Snider, meanwhile, lost a small automotive parts-packaging business, Paper Plas, after JP Morgan Chase pulled his financing.

The New York bank in 2008 encouraged Snider to seek alternative financing because, he said, Chase told him it was afraid his largest customer, Chrysler, might go out of business.

Ironically, the large New York bank also led a group of banks and hedge funds that held $6.9 billion in loans to Chrysler. The government forced those lenders to accept about 29 cents on the dollar as part of Chrysler’s restructuring.

Today, Paper Plas is out of business. Snider launched Walden Foods, which operates Papa John’s pizza restaurants in Washtenaw County and Coffee Bean & Tea Leaf shops at Detroit Metro Airport.

Despite higher auto production, aggressive government investment in alternative energy technology and modestly stronger retail sales, small-business owners are still struggling to find financing.

“We saw some easing three or four months ago, but that has ended,” said Paul Brown, manager of capital access for the Michigan Economic Development Corp. “Credit is as tight now as it ever has been. It is particularly disheartening when many businesses are seeing increased sales and growth.”

Conservative practices

Emerson has battled with local representatives of PNC Bank that acquired National City Bank in 2008 with the help of $7.6 billion in Troubled Asset Relief Program money. PNC has since repaid that aid, plus a 5% dividend and $324 million from the sale of warrants granted to the U.S. Treasury in exchange for the TARP funds, but it’s not exactly gung-ho about making new loans.

“Upon acquiring National City, PNC implemented its own credit and risk policies,” said Fred Solomon, a spokesman for the Pittsburgh-based bank. “PNC traditionally has had very conservative risk-management practices.”

American Gear’s experience illustrates why the economic recovery hasn’t gathered momentum. Despite modest, but fundamental signs of growth, the loans needed to respond to that growth remain scarce.

PNC has begun a “second-look” program under which it is reviewing some rejected loan applications from the past year. Spokesman Solomon declined to say what the results of the initiative have been.

Snider, who did secure financing for a new Papa John’s in Ypsilanti, understands the banks’ dilemma. After years of loose credit and little regulation, regulators are demanding they raise more capital and reject high-risk borrowers.

Conflicting messages

“The banks’ conflict is that whatever someone like Bernanke says ‘Make more loans,’ regulators in the field are not giving them the same message,” said Snider. “It’s not that they don’t want to lend.”

MEDC’s Brown said the best hope for breaking the lending logjam is the Small Business Lending Fund Act, which the U.S. House of Representatives passed last month. Now before the Senate, the bill would create a $30-billion fund designed to increase small-business lending by community banks.

Proponents of the bill say this will result in $300 billion in new credit and lending to entrepreneurs.

About $2 billion would be apportioned among states that have innovative solutions. For example, when a company’s machinery is appraised below the value needed to support a conventional loan, some SBLF money could subsidize that collateral so the bank would feel safer making the loan.

“Literally every day matters,” Brown said. “Every day we don’t have access to capital that many more small Michigan employers could go out of business or just brown out.”