Crain’s Detroit Business:

|

||

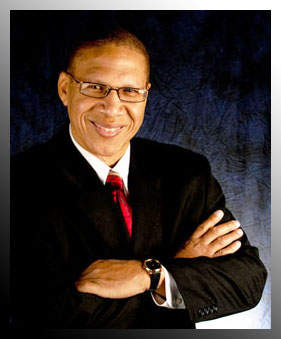

Home Federal Savings Bank, an iconic black-owned financial institution in Detroit, has fallen on hard times. The bank has been ordered by federal regulators to find a buyer by April 15. Failing that, its assets and charter could be sold by the Office of Thrift Supervision of the U.S. Treasury. A group of local black businesspeople, headed by Donald Snider, president and CEO of Detroit-based auto supplier Paper-Plas Converting Inc., hopes to persuade Home Federal’s management to sell the bank to them — or, if talks fail, to persuade OTS to let the group in on the bidding process. And Donald Davis, chairman of First Independence National Bank, Detroit’s other black-owned bank, said Friday that he hadn’t realized Home Federal was in such difficulty and would be interested in a possible acquisition. Thomas Williams, Home Federal’s president, declined to comment Friday about his reaction to the OTS order or about possible suitors. The bank’s attorney, Fallasha Erwin, who is also a member of the board of directors, said the OTS order has hurt negotiations for a possible sale. “How will someone negotiate in good faith when OTS put out a drop-dead deadline? We thought we had an agreement with a group out of North Carolina but suddenly they changed their terms,” he said. Erwin said Snider’s group made a low-ball offer to buy the bank last year that was turned down. He said a local community bank has offered to buy the bank but its offer was turned down because it was going to drop the name and fold the bank into existing operations. “We want to maintain the legacy,” said Erwin. Just weeks after Jackie Robinson broke the color line in Major League Baseball in May 1947, Home Federal broke a color line of its own — the color green. The thrift became the first black-owned banking institution in Detroit, providing mortgages to those often cut off from credit at other area banks. For decades, local black home buyers got their mortgages through Home Federal. At the time of its 50th anniversary, the thrift had $24.2 million in assets. But ironically, as other banks opened up their lines of business to minorities, Home Federal found it no longer had a captive market. Today, the bank has about $15 million in assets and has been operating under cease-and-desist orders issued by the OTS in July 2004 and October 2007, as well as a supervisory agreement in April 2007. Cease-and-desist orders are directives to improve practices and shore up balance sheets. “Home Federal served the community very well when no other financial institutions would, so hats off to them,” said Davis. “Unfortunately, the whole banking model has changed. It’s a different environment out there. We would welcome an opportunity to buy Home Federal, but we have not had any contact with any one, yet.” Home Federal was notified by OTS on Nov. 22 it had to file a plan by Jan. 5 on how it would restore enough capital to no longer be considered undercapitalized. According to the March 5 order, which said the ordered sale must close by June 30, no plan was ever filed. According to filings with the Federal Deposit Insurance Corp., the bank lost $100,000 in the fourth quarter that ended Dec. 31, its 11th consecutive quarterly loss. At year’s end, its core capital ratio was 3.87 percent. Six percent is considered well-capitalized and at least 4 percent is required in order to be considered adequately capitalized. The bank also has been hit hard by the local housing market slump. At the end of 2007, its noncurrent assets plus other real estate owned totaled just 0.83 percent of assets. As of Dec. 31, that had climbed to 4.14 percent. Late last year, the OTS levied a series of $250 fines against Home Federal directors for not ensuring compliance with previous cease-and-desist orders, and a series of $250 fines for the bank’s failure to file timely financial reports. Included were Bettye Arrington, Helen Coleman, Emeral Crosby, former local TV news personality Amyre Makupson and William Walsh. “We want to keep the bank in the community, and we want to maintain it as a minority-owned bank in Detroit. Most people my age and my parents’ age have dealt with Home Federal. They got their mortgages there,” said Snider. “We want to put in enough money to bring the bank back into compliance and to get it up to date. It doesn’t have a Web site, for example. And we’d market to the younger generation, those 20 to 40 who don’t even know the bank exists.” Snider said he is hopeful he and his partners can get talks back on track “now that Home Federal is out of bullets.” Previously, Snider’s group had filed with the state of Michigan and the Federal Deposit Insurance Corp. to form a new community bank based in southwest Detroit called First Spirit Bank. But with the economy in meltdown last summer, Snider and his group gave up on trying to raise the $8 million needed to launch the bank. Snider said he would be chairman of the bank if a sale is approved, and Lawrence Jones, a 35-year bank veteran and former chief administrative officer of commercial lending for Troy-based LaSalle Bank Midwest N.A. before it was bought by Bank of America, would be president. Ironically, Home Federal had been an early investor in First Spirit. Williams confirmed in a story by Crain’s in 2007 that the bank had invested $25,000 in First Spirit. Snider said that the plan then was for Home Federal to help First Spirit with its mortgage business. But Snider said the OTS made First Spirit return the money to Home Federal because the investment violated the terms of the cease-and-desist order under which it was operating. If there is a takeover by the OTS, it would be the second takeover of an area bank by federal regulators during the current recession. Main Street Bank of Northville was taken over in October and its assets sold to Monroe Bank & Trust. Area banks currently operating under letters of agreement with federal regulators as they attempt to improve operations are Farmington Hills-based Paramount Bank, Clarkston State Bank, Oxford Bank, Warren Bank and Farmington Hills-based Michigan Heritage Bank. |

||